Get Started With

servzone

Overview

Many people neglect creating a will for years & sometimes die without one. It is said that if the person died without a will, it is called as “intestate”. It also includes the property of a person who was inherited by his legal heir. In that case, they can go for the reinvestment deed, which allows for a seamless transfer of property - if there are two or more legal heirs, and may request to separate the property in the future.

A relinquishment deed is termed as a legal document where a legal heir gives up his/her legal rights to ‘inherited property’ In the belief of other heirs. When the person dies, the deed deed transfers ownership. The legal heirs (by inheritance) will transfer their shares in favor of a co-owner of the same property or an additional legal heir. A deed deed will be assigned either for consideration or without consideration. Conversely, the parties involved must co-own the property to be issued or transferred.

Key components

- Deed registration

The relevant deed is an essential legal document, called " of the concerned Sub-Registrar Office. Section 17 of the Registration Act, 1908 " It is mandatory to register with

. - Legal Rights

Through the successor deed (legal document) the heir may transfer or release his constitutional right to the inherited property.

- Thoughts

A valid idea (continued deed) or can also be reconsidered without consideration.

- Atal

Even if the undisputed deed is done without any consideration, it means that its release is irreversible by nature. If more than one person in question must have property for valid relief.

Essential ideas

- Title Description

The introduction section of the Relinquishment deed should contain the words ‘relinquishment deed/deed’ with the details of “date of creation” of the document.

- Executor and Reliever

Since rights in a property are issued by executing the document, the person who makes the reconsideration deed is known as the releasor / executor. Details like full name, father’s/husband’s name, and domestic address is required. It may be one or more of the prevailing shareowners.

- Releasee

The person is known as a releasee who receives the relinquished titles/ rights/share. Attention should be taken to comprise all details like full name, father’s/husband’s name, and full address.

- Property Description

Description of entire property is important (name of last owner). It is implied that it does not require a deed for a property owned solely by a sole proprietor, if there is currently no full owner. It is necessary to mention all the minute details such as a complete address, registration details, survey number, sub-registrar office details such as volume number, book number, office name, etc.

- intestate There would be no 'complications' that would amplify the creation of a relinquishment deed if there been a testament/will. It is because since division would be comparatively more straightforward and obviously with different shares.

- Heir Particulars

All present heirs to that property must be named preferably in a table with details like age, address, details of name/title, and relationship to the deceased ‘absolute owner.’

- Share Particulars

The property will be owned by heirs according to the applicable “Succession Act” if there is no existing will to the creation of the relinquishment deed, the proportion of shares held by each heir up should be stated.

- Disclaimer

Religion / executor issuing in their 'share' property, in favor of the issuer, is the most important clause in a deed deed. It should be mentioned that this is done with natural love and affection and without any monetary consideration.

The property should once again be terminated with the declaration that he and his legal heirs will have no claim over the property mentioned. It would be said that property rights would be made solely with the issuer, if all the remaining heirs would issue their shares in favor of one heir.

- Authorized Signature

All issuers and executors will sign the document. Before being registered at the designated sub-registrar office, it must be verified by two witnesses where the property is located.

Benefits

-

Uninterrupted Transfer A deed of deed is responsible for the smooth transfer of jointly owned property.

- If there is no safe transfer

If written by a deceased person (or entered) in the event of death of a person, in that case, the relief deed will be exempted in the transfer of property.

- Other Heirs

A deed allows the ownership of legal legal heirs to be transferred to additional legal heirs.

Required documents

- Property Legal Documents

- Registered Documents

- Intent stating a written document

- Co-owner Details

- Specifications are required for the release deed

- Releasor's name, age, address

- Name, age, address of the issuer

- Property Description

- Details on the consideration, if any.

- Aadhaar card, ID proof, such as driver's license, passport, etc.

- PAN card of both parties for execution of Religion Deed.

- You will need two witnesses at the time of execution of Religion Deed

- Other agreements you may have entered into with respect to the property

- Other materials may be required as per state requirements.

Registration process

As per Section 17 of the Registration Act, 1908, the relief deed must be registered. This is because the above deed is a legal document in which a legal heir transfers his constitutional rights to inherited property as a pity of another. Legal heir.

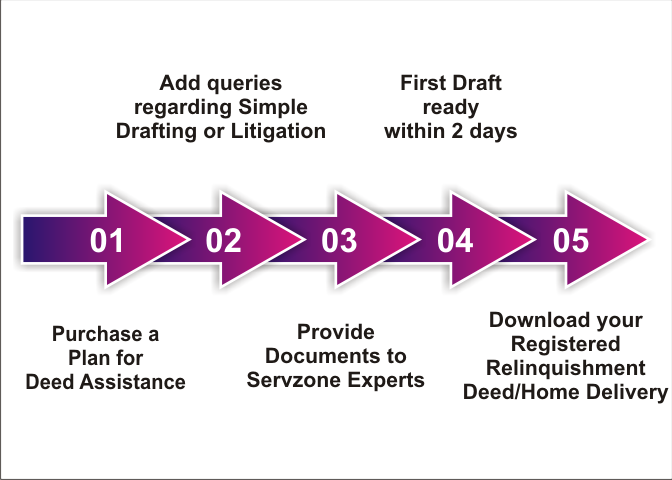

Registration of the registration deed involves the following steps. They are as follows: -

- The preparation / drafting of the registration deed is the first step towards the registration process. We advise you to consult a lawyer who can draft the deed as per your requirement.

- Renewal deed has to be printed on Rs 100 stamp paper. Each statement should be mentioned in the deed of the property concerned.

- If the deed is prepared, the next step is to present it to the sub-registrar within the jurisdiction where the property is located.

- After this, you have to pay the registration fee for its registration. Usually, it varies between '100 - 250 rupees' in each state as the registration fee varies from state to state.

- On the fixed day for registration of a deed, both parties and two witnesses must obtain an appointment (physically visit) to the sub-registrar's office. Get all documents with you for verification and registration process as required.

- One week after the above listed process is completed, a registered reset deed can be obtained.

- In cases where a person is physically incapacitated and cannot visit the office of the Sub-Registrar, a provision has been made under 'Section 31 of the Act' to the Registration Officer. It helps in submitting a resignation letter for registration for physically challenged people at any person's place of residence.

- It should be noted that the unregistered issue deed is not a valid deed and is not eligible to contest in court.

Procedure

A relief deed is a mandatory legal agreement, the terms of which are fundamental to the existence of the transfer of property. The relief deed will be prepared with careful consideration, and a lot of time should be allowed for all stages of the drafting registration process. It is advised that a real estate lawyer with significant 'property transfer experience' should be appointed to overcome the many potential pitfalls that creep within the relief property.

Servzone advises you to get in touch with an advisor to understand the requirement in detail. Initial information will be mandatory from your end to start the process. After providing all the information, the lawyers will start working on your document and payment will be received. The servzone legal representative will coordinate with the sub-registrar's office and secure a date for the registration process. Also, you will get the first draft of your authorized document within a few days. You can evaluate the document, and intimate it for improvement in case of any amendment.

Why servezone?

Servzone is one of those platforms that coordinates to meet all your legal requirements and continuously connects you with professionals. Yes, our clients are pleased with our legal service! Due to our focus on simplifying legal requirements, they have consistently treated us very well and provide regular updates.

Our clients can track progress on our platform at all times. If you have any questions about issuing for the registration process, our experienced legal advisors are just a phone call away. Servzone will ensure that your communication with professionals is engaging and seamless.

Important points

- The person who is the legal heir of the property can only be considered for reinvestment of the property and only by him. If a property has more than one heir, both co-owners can reconsider.

- In the name of a person, one can renounce property which is the 'co-owner' of the said property. Apart from co-owners, property cannot be relinquished in favor of an individual.

- If a person (who is not the 'legal heir of the property') is relieved, the transaction will be treated as a 'gift'.

- The deed signed by at least two witnesses and all parties must be signed.

Validity

If the following conditions are met, the problem deed will be considered valid. Follow those conditions: -

- The person should be interested in the property which is leaving the property.

- Apart from the self-acquired property of the father (no membership for the lifetime of the father), the property to be rejected should be the property (accepted membership) of the joint Hindu family.

Is it possible to challenge the deed of an issue?

Large and, if a person has transferred their claim on the property, they have changed their mind, any registered deed cannot be canceled on this basis only. The resignation used to repeal a general contract can be challenged on the same grounds. It cannot be changed only as per your wish, but when there is a deficiency in the agreement.

The parties involved, that is, the person must give their consent to the cancellation, in whose favor it was relinquished and who gave up their property to cancel the deed. If the beneficiaries of the property are reluctant to cancel the deed, you can also approach the civil court to have the deed canceled. According to the Act, the limit of the period available for challenging the relief deed is three years.

GST Registration

PVT. LTD. Company

Loan

Insurance